Will vs. Living Trust - What is best for you?

The most common question people ask a Los Angeles estate planning lawyer is whether making a will is enough or if a living trust is still required for avoiding probate.

What is Last Will and Testament?

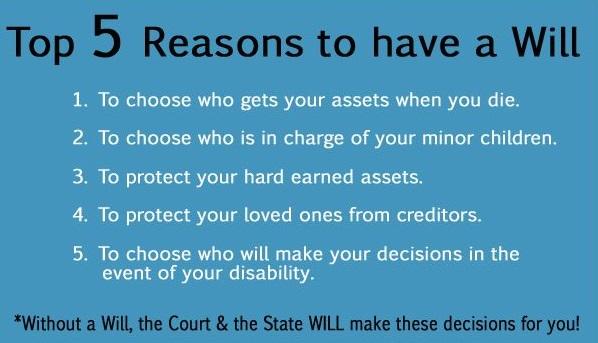

A last will and testament is a legal document that basically says who will inherit your property and assets after your death. It allows you to designate beneficiaries and distribute your estate among them.

What is a Living Trust?

A Living Trust is different than a Will as it becomes active as soon as it is signed. This means it provides lifetime as well as after-death property management. It is revocable which means that you can make changes to it if needed.

Will vs. Living Trust

| Will | Living Trust |

|---|---|

| A will is simply a description of your property and who gets it. |

requires you to name someone you trust to manage your estate for beneficiaries. |

Setting up a will is rather simple and requires you to sign the document in the presence of witnesses. |

Living trusts are considerably more time-consuming to establish and involve estate planning attorneys to help you through. |

A will is typically less expensive than setting up a living trust. |

Setting up the trust is an expensive process. |

| In a will, you own the property and creditors can sue you for claims. |

Creditors cannot bring claims against your property in a living trust. |

Do I Need a Will or a Living Trust?

Both Wills and Trusts are estate planning tools which state the distribution of your estate upon your death. Deciding whether a will or a trust is best for you depends on the circumstances. It also depends upon your age, how wealthy you are, and whether you’re married.

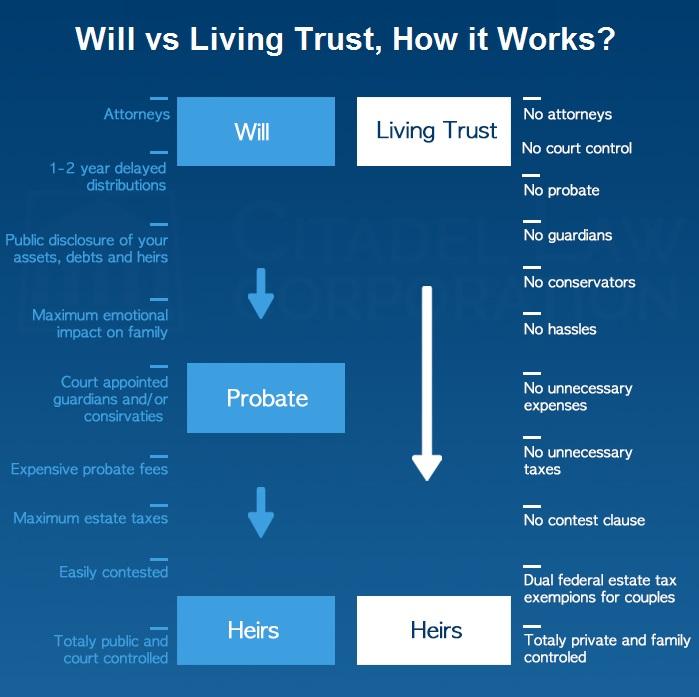

The infographic below shows how the will and the living trust work:

To determine whether you need a trust or a will, also take into consideration the following factors:

Is Informal Probate an option?

Some states in the U.S. allow a simplified process of probate for estates under a certain dollar threshold. If you live in a state where the probate isn’t a complex or burdensome process, you should opt for a will.

Is your Estate wealthy?

If you have a valuable estate that exceeds the current tax threshold, you should consider a living trust. Setting up a trust with tax planning provisions, allows you to save substantial taxes.

Children:

In case you have minor children you should go with a living trust. A trust allows for establishing provisions when a child is entitled to assets held in a trust.

Privacy:

If privacy is a concern for you, opt for a trust. After death, a will becomes a public document, whereas a living trust does not.

In case you are still doubtful, consult an estate planning law firm for addressing your needs. The question of which is best among a will or a trust for you, can be answered by an attorney.