Updated: August 8, 2018

When new clients come to our office asking us to review an old estate plan to determine whether it needs to be updated, one of the first things we check is whether the client’s home is properly titled under their revocable living trust.

You can have the best written trust in California, but your beneficiaries will run into legal problems after you pass away if you don’t properly transfer title of your home to your trust during your lifetime.

The first problem is your home could still go through probate even with a trust. If your trust fails to properly identify your home, then chances are, it will need to go through probate before your family can get their hands on it.

The second problem is the probate judge might not honor the wishes you wrote in your trust. Instead, he'll give your home to someone else. For example, if your trust says you want to leave everything to charity but your home isn't listed as a trust asset, then your home will be distributed based on California law. In that scenario, your husband and kids will have priority over your home, not the charity.

The third problem is that your family may need to spend unnecessary attorney’s fees correcting your mistake in court. If you listed your home as an asset in your trust but didn’t sign a new deed to formally transfer title to your trust, then your heirs will have to file what’s known as a “Heggstad petition” to tell the court that you intended to put your home into your trust, but simply didn’t follow the correct legal procedure to do it while you were alive.

Luckily, you can easily avoid these problems.

Here are four things to check:

1. Is your home listed in your trust’s schedule of assets?

On the back of your trust should have a page that’s titled, "Schedule of Assets." Make sure the address of your home is listed on the schedule. This shows your intention to put your home in your trust and allows the terms of the trust to govern who gets your home when you die.

2. Did you sign and notarize a new deed when you created your trust?

Make sure you signed and notarized either a quitclaim deed or a grant deed that shows your house was transferred from your individual name to your living trust.

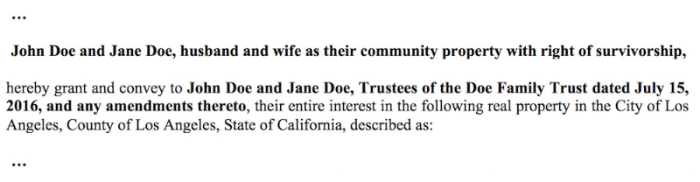

Usually, it looks something like this:

Some attorneys prefer to record the deed at your local recorder’s office, while others don’t. I prefer to record them.

3. Does the name of your trust on the new deed match the name on the trust itself?

Make sure the name of your trust is exactly the same named used in your trust and in your new deed. When using your trust to hold title to any real property in California, you should use the full legal name of your trust.

Generally, the full legal name of your trust is formatted like this: “Your name, trustee of your living trust, dated ______.” So if your names are John Doe and Jane Doe, your trust is named the Doe Family Trust, and it was signed on July 15, 2016, then the legal name of your trust is:

John Doe and Jane Doe, Trustees of the Doe Family Trust, dated July 15, 2016.

Some trusts end with “ . . . , and any amendments thereto.”

4. Did you add the name of your living trust as an insured under your home insurance policy?

If you record a new deed that names your trust as the new owner of your home, make sure you contact your home insurance agent to add your trust either as the primary insured or as an additional insured. The last thing you want is for your insurance company to reject your property damage claim because your trust isn’t listed as an insured under your policy.

Your home is probably one of your biggest assets, so make sure you hire an attorney to check if it’s properly titled so your wishes are carried out and your heirs avoid an expensive probate administration. If you need a review of your existing estate plan, we’re always here to help.

And if you own a home in California without a trust, you're in trouble (read THIS and THIS). Put your home in your trust as soon as possible.

To schedule a free consultation with an experienced estate planning attorney, call (626) 307-2800.